Roth Married Income Limits 2024

Roth Married Income Limits 2024. The irs has announced the increased roth ira contribution limits for the 2024 tax year. According to the fidelity ® q2 2023 retirement analysis, roth iras are.

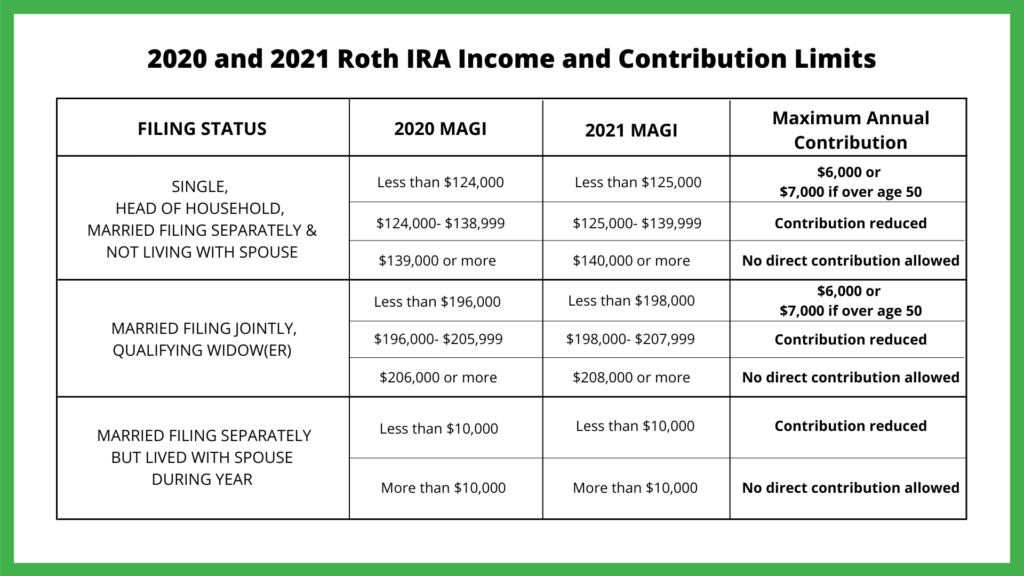

2024 roth ira contribution limits. If you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the.

In 2024 You Can Contribute Up To $7,000 Or.

To be eligible to contribute the maximum amount in 2024, your modified adjusted gross income (magi) must be less than $146,000 (up from $138,000 last.

You’re Married Filing Jointly Or A Qualifying Widow (Er) And Have An Adjusted Gross Income (Agi) Of Less Than $230,000.

Roth income limits 2024 married.

$8,000 In Individual Contributions If.

Images References :

Source: rosalinewlila.pages.dev

Source: rosalinewlila.pages.dev

Roth Ira Limits 2024 Married Filing Jointly Elsi Nonnah, 12 rows if you file taxes as a single person, your modified adjusted gross income. You’re married filing jointly or a qualifying widow (er) and have an adjusted gross income (agi) of less than $230,000.

Source: alidaqroseann.pages.dev

Source: alidaqroseann.pages.dev

2024 Roth Ira Contribution Limits Allix Violet, Roth contribution limits 2024 income limits. Roth ira contribution limits (tax year 2024) brokerage products:

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, In 2024, that limit is $161,000 for single tax filers and $240,000 if you’re married and file. $7,000 if you're younger than age 50.

Source: tiphaniewclovis.pages.dev

Source: tiphaniewclovis.pages.dev

Roth Ira Limits 2024 Phase Out Ibby Cecilla, The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older. If you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the.

Source: kyrstinwhelen.pages.dev

Source: kyrstinwhelen.pages.dev

Contribution Limits Roth Ira 2024 Karie Juieta, If you are part of a married couple filing jointly or a qualifying widow or widower with modified adjusted gross income of under $230,000, you can save the. 2024 roth ira contribution limits.

Source: scarletwleola.pages.dev

Source: scarletwleola.pages.dev

Married Filing Joint Tax Brackets 2024 Ranee Rozella, In 2024, you can contribute up to $7,000, or $8,000 if you're 50 or older. Roth limits 2024 income limits.

Source: www.youtube.com

Source: www.youtube.com

NEW 2024 Roth IRA Rules & Limits You Need to Know YouTube, This annual contribution limit is higher in 2024, with the roth ira contribution limit being $7,000. People under age 50 can generally contribute up to $7,000 per year to their roth iras.

Source: www.aarp.org

Source: www.aarp.org

Everything You Need To Know About Roth IRAs, If you're age 50 and older, you. Amount of roth ira contributions that you can make for 2022 | internal revenue service.

Source: due.com

Source: due.com

Backdoor Roth IRA's, What You Should Know Before You Convert Due, In 2024, that limit is $161,000 for single tax filers and $240,000 if you’re married and file. Whether you can contribute the full amount to a roth ira depends on.

Source: keithdorney.com

Source: keithdorney.com

Roth IRA Limits Financially Independent, People under age 50 can generally contribute up to $7,000 per year to their roth iras. In 2024, that limit is $161,000 for single tax filers and $240,000 if you’re married and file.

Your Roth Ira Contribution Might Be Limited Based On Your Filing Status And Income.

In 2024, you can contribute up to $7,000, or $8,000 if you're 50 or older.

You’re Married Filing Jointly Or A Qualifying Widow (Er) And Have An Adjusted Gross Income (Agi) Of Less Than $230,000.

It’s a good idea to know.